Determining land value for depreciation

Step 3 Divide the value of the house by the value of the property. Subtract the land value from your cost basis.

Revaluation Of Fixed Assets Bookkeeping Business Accounting Education Fixed Asset

100000 cost basis x 1970 1970.

. When accounting for a land and building purchase a good rule of thumb to use is the 2080 rule. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. The productive or profitable.

Percentage allocation is one way to make a decision. Calculate your annual depreciation by dividing the. 5 Methods To Calculate Land And Property Value In India How To Calculate Land.

The formula for this type of depreciation is. You can depreciate your 75000basis in the building using the mid-month MACRS tables. I own a condo in a multi-unit condominium in Manhattan.

Improvements 60000 75 Land 20000 25 Total Value. How to Calculate Salvage Value. Posted Feb 12 2019 1201.

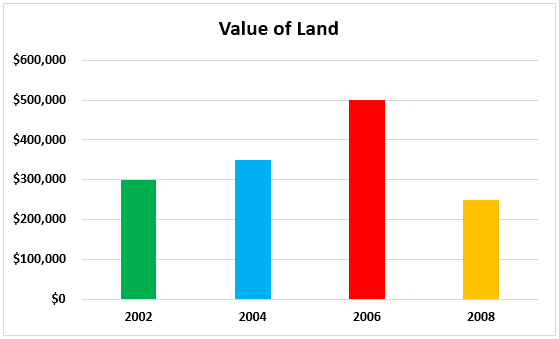

Determining Building value vs Land value for Depreciation in NYC. Depreciation of property value is the decrease or dip in the selling value of your home. In such cases depreciation is arrived.

Land value is exempt from depreciation because land. Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial cost. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

Sum of digits depreciation Depreciable cost x Balance useful lifeSum of years digits Example. For example the first-year. Multiply the purchase price 100000 by 25 to get a land value of 25000.

The remainder is the buildings basis which is usually fully depreciable over 275 years. Multiply your result by your cost basis to determine the cost basis of the house which is the amount you depreciate. The building is the major asset representing approximately 80 of the purchase.

How to calculate the annual depreciation amount. If you do not have any information to determine land value the IRS auditor will not have any information either. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

This is calculated as the factor product of the total value of the property with the age of. Determine the cost of the asset.

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Depreciation Of Building Definition Examples How To Calculate

Calculating The Land And Building Value Of Your Rental Property

How To Find The Market Value Of Vacant Land Retipster

How To Find The Market Value Of Vacant Land Retipster

Calculating The Land And Building Value Of Your Rental Property

2

What Are Land And Buildings Bdc Ca

How To Find The Market Value Of Vacant Land Retipster

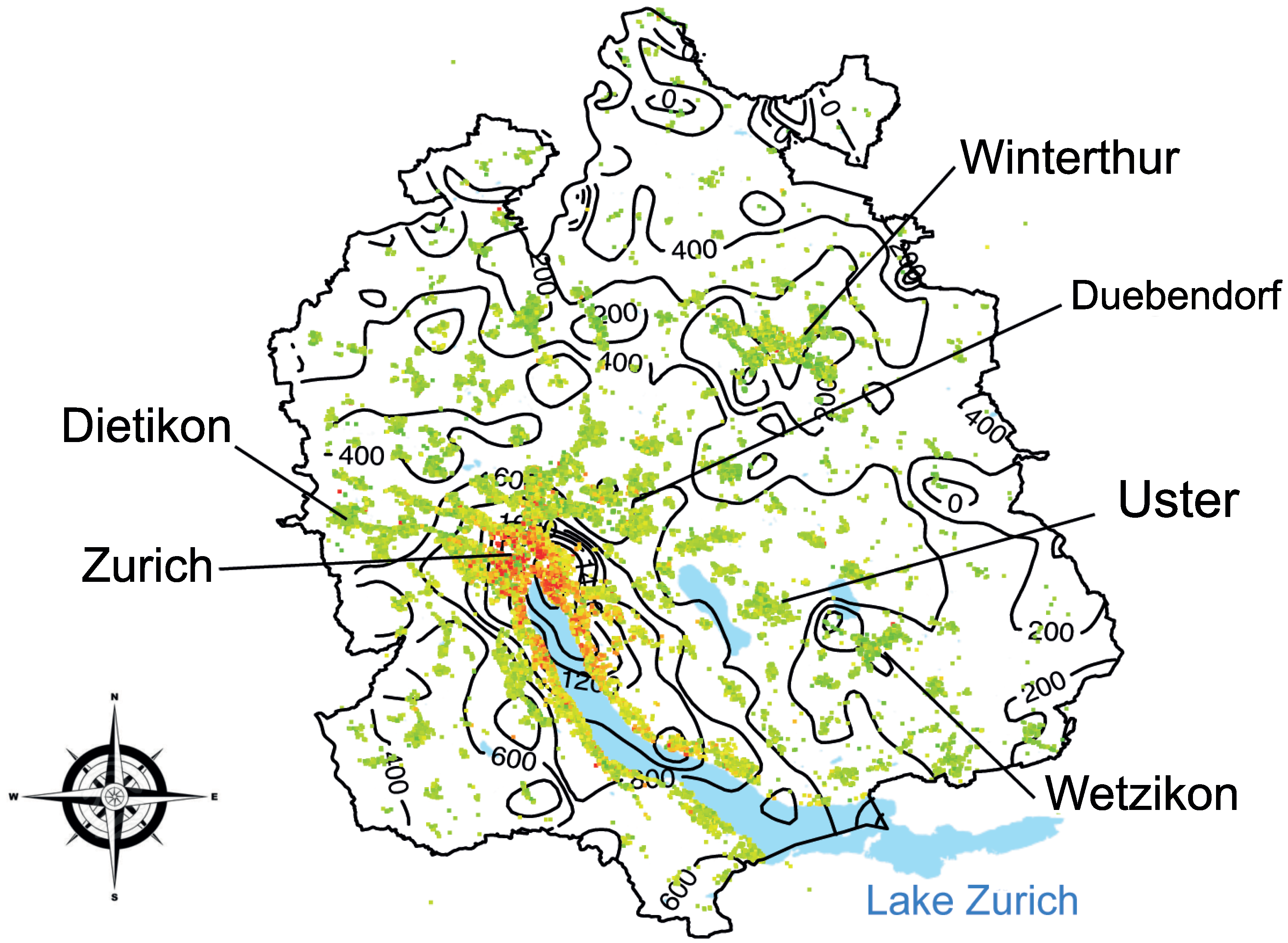

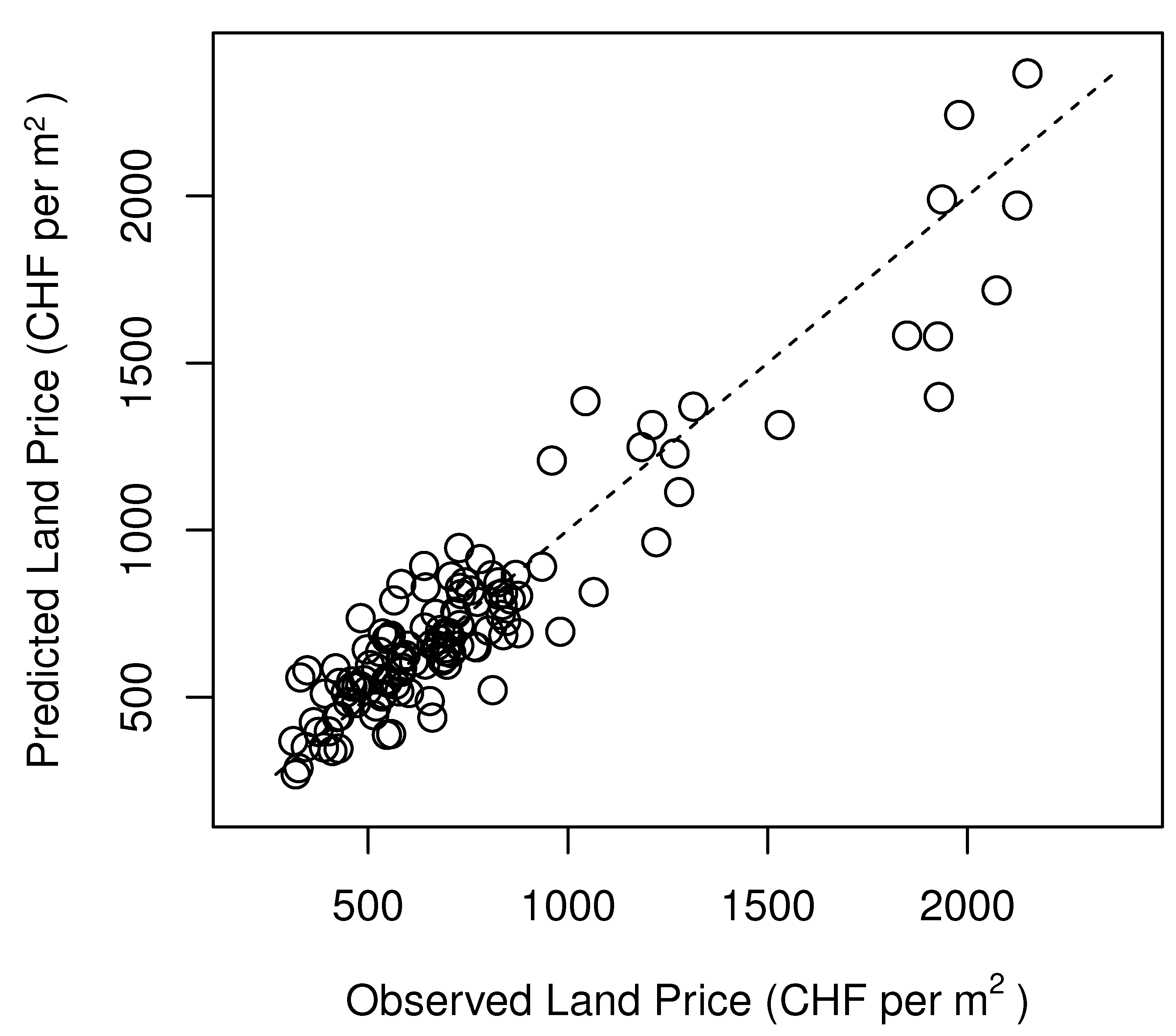

Land Free Full Text Determining Land Values From Residential Rents Html

Does Land Depreciate In Value Accounting Effect Examples

How To Use Rental Property Depreciation To Your Advantage

4 Steps On How To Calculate Land Value

Land Free Full Text Determining Land Values From Residential Rents Html

5 Methods To Calculate Land And Property Value In India

Does Land Depreciate In Value Accounting Effect Examples

Straight Line Depreciation Calculator And Definition Retipster